06/25/2021

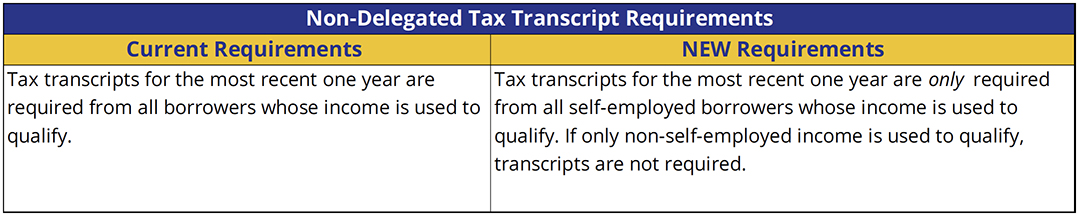

Effective immediately, PennyMac is updating the requirements for non-delegated loans as shown on the below table:

Please note that PennyMac may also require transcripts in instances where questions arise on the validity of the income or when additional income verification is required.

There are no changes to the existing additional tax transcript related requirements:

- When tax transcripts are provided, they must support the income used to qualify.

- A properly executed 4506-C is required for all transactions except:

- If the loan file contains tax transcripts, or

- When all of a borrower’s income is validated by the DU validation service (FNMA only)

- If tax transcripts are not available (due to a recent filing for the current year) a copy of the IRS notice showing “No record of return filed” is required along with a documented acknowledgement receipt (such as IRS officially stamped tax returns or evidence that the return was electronically received) from the IRS and transcripts from the previous year.

Please contact your Sales Representative with any questions.